Klarna

We’re excited to announce we have partnered with Klarna to bring you new ways to pay at checkout.

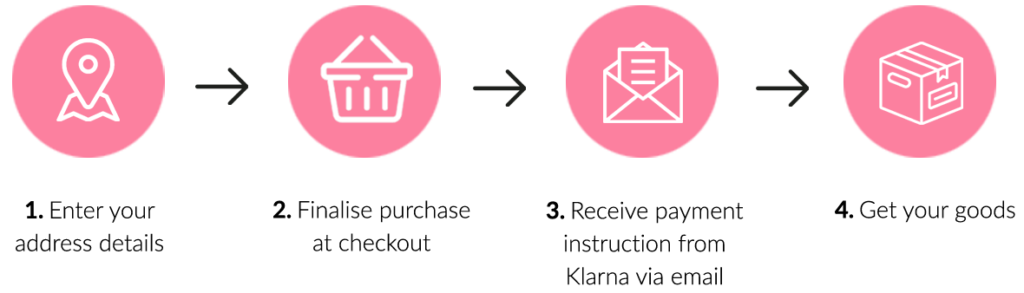

Here’s how it works:

Step 1

Add products to your cart and select “Klarna” when you check out.

Step 2

Enter a few personal details and you’ll know instantly if you’re approved.

Step 3

Klarna will send you an email confirmation and reminders when it’s time to pay and you can manage your orders and payments in the Klarna app.

Pay in 30 days:

Make your purchase today so you can try before you buy. Only pay for what you keep. Pay up to 30 days later. No interest. No fees when you pay on time. No impact to your credit score.

- Paying after delivery allows you to try before you buy and is the easiest way to shop online.

- Complete the payment in full after purchase at no added cost.

- Report returns directly in our app and only pay for the items that you keep.

- Not making your payment on time could affect your ability to use Klarna in the future.

- Debt collection agencies are used as a last resort.

You must be 18+ and a UK resident to be eligible for this credit offer. Pay Later Terms and Conditions .

Pay in 3 interest-free instalments:

Spread the cost of your purchase into 3 interest-free instalments. The first payment is made at point of purchase, with remaining instalments scheduled automatically every 30 days. No interest or no fees when you pay on time. Select the Klarna option and enter your debit or credit card information. To check your eligibility, Klarna will perform a soft search with a credit reference agency. This will not affect your credit score.

No interest. No fees when you pay on time. No impact to your credit score.

- A new way to pay that’s an alternative to a credit card.

- 3 instalments gives you flexibility to shop without interest or hidden fees.

- Not making your payment on time could affect your ability to use Klarna in the future.

- Debt collection agencies are used as a last resort.

You must be 18+ and a UK resident to be eligible for this credit offer. Pay in 3 Terms and Conditions.

FAQ's

Klarna is a payments service that helps you buy the things you want or need. Right now, over 100 million people worldwide use Klarna at over 200,000 online stores.

Pay later in 30 days is a credit product which lets you pay any time within 30 days of your purchase without interest or fees. You can make this payment using a credit or debit card on the Klarna app or logging into www.klarna/com/uk. Klarna will send you a confirmation email once your order is confirmed with full details. You can see both past and future payments using the Klarna app.

Klarna’s Pay in 3 instalments is a credit product that lets you spread the cost of your purchases over 3 equal payments. Klarna will take the payments from your debit or credit card directly so you don’t have to worry about missing a payment. Klarna will take the first payment when you make the purchase, the second 30 days later and the final payment 60 days from your purchase date. You can see your past and future payments at any time using the Klarna app.

You need to be at least 18 years old and a UK resident to use Klarna’s credit products including Pay in 3 instalments. When you choose Klarna they will also check the information you provide and your financial situation.

Yes, you can. If you see Klarna Pay in 3 instalments when you go to an online checkout then Pay in 3 instalments is available to you. Every time you use Pay in 3, Klarna will check to see whether you can use Pay in 3 again for each additional purchase.

You can pay any time within 30 days of your purchase without interest or fees. You can make this payment using a credit or debit card on the Klarna app or logging into www.klarna/com/uk. Klarna will send you a confirmation email once your order is confirmed with full details.You can see both past and future payments using the Klarna app.

Payment information is processed securely by Klarna. No card details are transferred to or held by Best at. All transactions take place through connections secured with the latest industry standard security protocols.

Klarna will notify you by email and push notification when a payment is due and when you have made or missed a payment. You can always check the status of your order and payments in the Klarna app or by logging in at www.klarna.com/uk.

Pay later in 30 days is a credit product and you are required to make your payment to Klarna. Klarna may also share information about your missed payments with credit reference agencies. This means you may find it difficult or more expensive to use Klarna or other lenders’ credit products in the future. Full details can be found in the Klarna terms and conditions here.

If you have not received your goods please contact Best At to check on your order and delivery status. You can also contact Klarna’s Customer Service so that they can postpone the due date on your payment or put the order on hold in the Klarna app while you wait for the goods to arrive

As soon as Best At confirms with Klarna that your cancelation / return has been accepted, Klarna will cancel any future scheduled payments as well as refund any amounts due. You will see the return in the Klarna app immediately.

Visit the Klarna app Klarna’s Customer Service page for a full list of FAQs, live chat and telephone options.